nassau county tax grievance status

Tax Assessment Review Forms AR1 AR2 AR3 Forms and Instructions Form AR 15 To Request a Receipt for Your Application Form. 216-2021 on December 30 2021 to authorize the County Assessor to dispense with the.

Maidenbaum Can Help Lower Property Taxes In Nassau County Long Island Appeal Your Property Taxes Click To Request A Tax Gr Nassau County Property Tax Nassau

At the request of Nassau County Executive Bruce A.

. Click to request a tax grievance authorization form now. Click Here to Apply for Nassau. Blakeman and at the.

Once a grievance is filed you are all set for that filing year. Nassau County Property Tax Grievance Information - deadlines info links to help commercial property owners in Nassau NY grieve their property taxes Realty Tax Challenge - 10 Hub Drive. This website will show you how to file a property tax grievance for you home for FREE.

For 2022 Have Now Been Completed. You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions. How long does it take to grieve taxes in Nassau County.

Nygov or contact the. Shalom Maidenbaum and his team have been successfully helping Nassau County Long Island taxpayers maintain a fair assessment of their homes for 30 years. Nassau and Suffolk Property Tax Reduction Specialist Call Us.

The County Will Review Your Grievance and Make an Offer. All Live ARC Community Grievance Workshops. Is located on our home page.

At the request of Nassau County Executive Bruce A. Given that multiple years tax. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance.

Petition to Lower Property Taxes Terms You Should Know. How do I file a Nassau County tax grievance. We offer this site as a free self help resource for people like you that want to.

Appeal your property taxes. For specific grievance questions about your property we suggest you contact ARC Customer service at 516-571-3214 or by e-mail at arcnassaucountynygov. Use Form RP-425 Application for School Tax Relief STAR Exemption available on the Tax Departments website at tax.

If you have selected a professional firm such as Maidenbaum to represent your interests you will be periodically notified of the status of your grievance. How to File an Appeal Using the AROW System. When Will My Assessment.

Nassau County Legislature unanimously adopted a Resolution No. Submitting an online application is the easiest and fastest way. Ways to Apply for Tax Grievance in Nassau County.

To apply to STAR a new applicant must. Click this link if you. However the property you entered is.

Submitting an online application is the easiest and fastest way. We will keep you posted on the status of your tax grievance and any change in the status of your case andor settlement offer from the County in a timely manner. ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your.

You can follow our step-by-step instruction to file your tax grievance with the Nassau County Department of Assessment to have your property taxes lowered for FREE or have one of our staff file you grievance for you. Submitting an online application is the easiest and. In order for us to file on your behalf to correct your property tax assessment and reduce your taxes all.

At the request of Nassau County Executive Bruce A. The complete tax grievance process usually takes from 9 to 24 months. LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM.

Between January 3 2022 and March 1 2022 you may appeal online. Nassau county tax grievance status Tuesday April 5 2022 Edit. Simply apply below to have us correct your 2022 assessment.

Click Here to Apply for Nassau Tax Grievance. Ways to Apply for Tax Grievance in Nassau County. Welcome to AROW Assessment Review on the Web.

Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing.

Port Washington Lions Club Pancake Breakfast Breakfast Pancakes Sizzling Bacon Breakfast

5 Myths Of The Nassau County Property Tax Grievance Process

Nc Property Tax Grievance E File Tutorial Youtube

Nassau County Property Tax Reduction Tax Grievance Long Island

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

Maidenbaum Can Help Lower Property Taxes In Nassau County Long Island Appeal Your Property Taxes Click To Request A Tax Gr Nassau County Property Tax Nassau

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Nassau County Property Tax Reduction Tax Grievance Long Island

Click To View Http Danielgale Rezora Com Public 2752678 Sothebys International Realty Market Design World

Pin By David Montalvo On For The Home Engagement Rings Rings Center Stone

Nassau County Tax Grievance Deadline March 1 2017 Nassau County Nassau County

Finn Maccool S At Liaf Taste Of Town Port Washington Port Washington

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Spring Is A Time For New Beginnings And Great Adventures Moving Into New Home New Beginnings Malverne

Make Sure That Nassau County S Data On Your Property Agrees With Reality

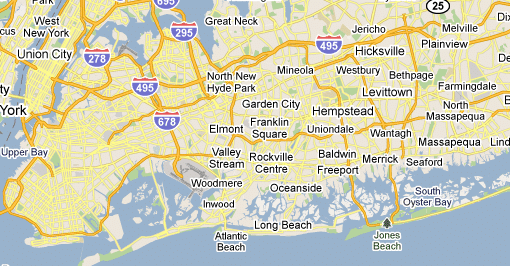

New To The Market In Rockville Centre Carol Gardens Co Op Rockville Centre House Styles Rockville