does oklahoma have an estate or inheritance tax

But just because youre not paying anything to the state doesnt mean that the federal government will let you off the. Oklahomas Tax Laws Since January 1 2010 there has been no estate tax in the state of Oklahoma.

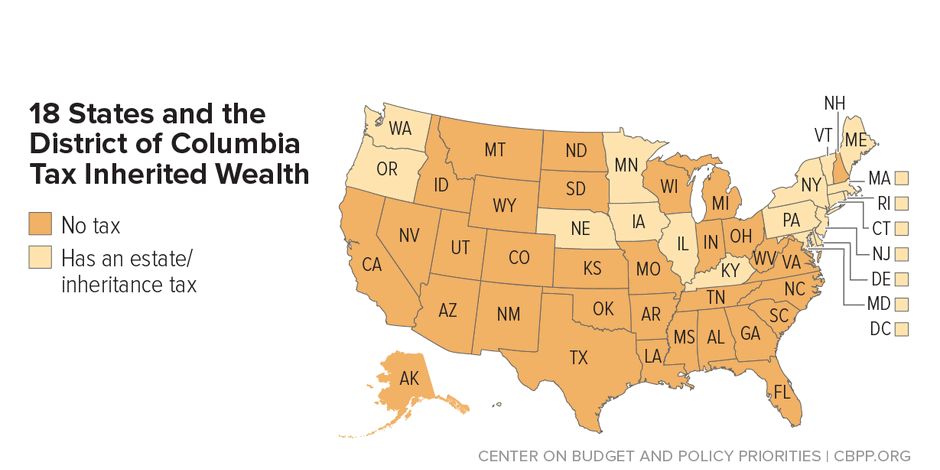

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax.

. Oklahoma does not have an inheritance tax. Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19. The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. No estate tax or inheritance tax. What Is the Federal Inheritance Tax Rate.

Does Oklahoma Have an Inheritance Tax or Estate Tax. If you inherit from someone. Does Oklahoma Have an Inheritance Tax or Estate Tax.

The fact that Oklahoma does not have an inheritance tax means that the states resident does not have to pay any taxes when they inherit an estate located in the state that. Connecticuts estate tax will have a flat rate of 12 percent by 2023. In addition to the repeal of the.

States That Have Repealed Their Estate Taxes. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. Since January 1 2005 Arkansas has not collected a state.

Consult a certified tax professional with any tax-related questions Oklahoma does not have an inheritance tax. Lets cut right to the chase. The minimum amount that an estate can be valued at without being subjected to an estate tax in New York is 593 million at which point an estate executor must also file a.

If you live in oregon you can be. Delaware repealed its tax as of January 1 2018. The Office for Budget Responsibility is.

Seven states have repealed their estate taxes since 2010. 20 hours agoReceipts from estates paying Inheritance Tax in the tax year 202122 alone were 616 billion up 739 million on the previous year. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

What is the estate tax in Oklahoma. There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased person. However a federal estate.

Even though Oklahoma does not require these taxes however some individuals.

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

States With No Estate Or Inheritance Taxes

Inheritance Tax Oklahoma Estate Tax Estate Planning Lawyer

Do I Need To Pay Inheritance Taxes Postic Bates P C

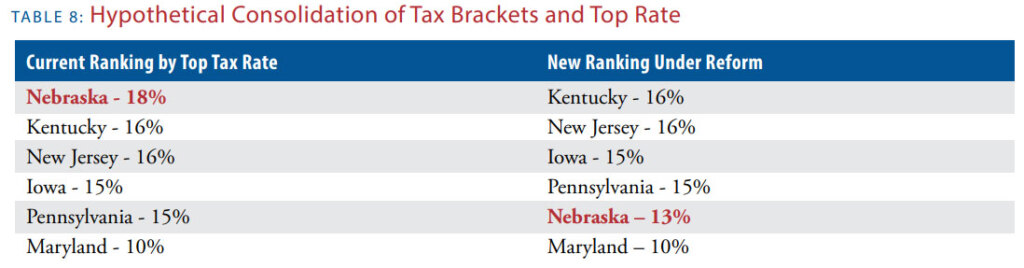

Death And Taxes Nebraska S Inheritance Tax

Pa 221 Probate Administration Federal Taxes That Could Be Imposed On Someone S Estate Upon Their Death Unit 8 Taxation Ppt Download

State By State Estate And Inheritance Tax Rates Everplans

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

Death And Taxes Nebraska S Inheritance Tax

Oklahoma Inheritance Laws What You Should Know Smartasset

Federal Estate Tax Exemption 2021 Cortes Law Firm

An Explanation Of Federal Estate Taxes In Plain English

States With No Estate Or Inheritance Taxes

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Estate And Inheritance Taxes In Oklahoma Tax Strategies Planning

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Eleventh Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1952 And Ending June 30 1954 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information